Tip №1. Make a list of debts

Not everyone keeps records of their debt, probably so as not to feel guilty. But you need to know the enemy, so it’s better to know exactly to whom and how much you owe. Write down all debts according to the following scheme: lender, rate, term, balance, minimum payment.

Tip №2. Work out your priorities

It is necessary to understand which debts to close first, and which can wait a little. To do this, you should divide all obligations into “long” and “short”.

“Short” is most often the unnecessary costs that our wishlist has led to. This category includes: debt on payday loans and credit cards, as well as consumer loans in cash. At the same time, “long” means investments in the future: car loans, tuition loans and business development, mortgages. The very name “short” contains a recipe — you need to cover them first and you can easily cope with them in a short time.

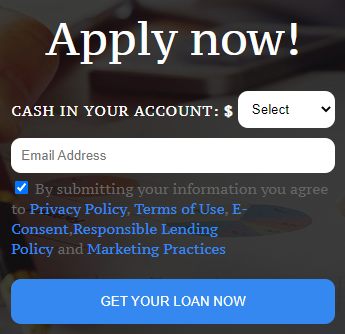

But if you have to issue short-term loans, you may use the form below to find the right lending option:

Tip №3. Report your financial problems to the lender

If the income is not enough to cover all the obligations, go to the bank and honestly admit it. A banking specialist will assess the situation and help find a solution that suits both sides. Making delays and hiding is a bad option, since your credit history will be ruined.

What options can lenders offer you?

Payment holidays are the best solution for temporary financial difficulties: finding a new job after dismissal, treatment, etc. Payments will be frozen or revised for a certain period, usually for 3 months, and then they will resume. There are several possible options: pay nothing, pay a smaller amount, or only interest.

Refinancing is the registration of a new loan to pay the old one, but on more favorable terms. It is relevant if the loan was taken out a long time ago and interest rates have fallen during this time, or if there are several loans and you want to combine them into one more profitable one. Refinancing can be carried out by both the current and the new lender.

Restructuring is the extension of the loan term, due to which the monthly payment will decrease. As a result, you will have to pay more interest, but the payments will become feasible.

Tip №4. Pay over the minimum

A significant part of the minimum loan payment is interest, therefore, by adding even a small amount, you will cover with your debts faster. Add 10% to each payment and deposit money regularly (if necessary, set a reminder), this will allow you to get used to financial discipline. And in the future, the habit of saving 10% will help get savings.

Tip №5. Connect autopayments

Shopping is always more pleasant than paying off debts. To keep you out of shopping, enable automatic withdrawal from the card. The money will be debited at the specified time and date, thereby you will discipline yourself, eliminate delays.

Tip №6. Understand your expenditures

In the mobile applications of many banks, you can analyze your spending. You can also install an additional income and expense management application on your smartphone or record them in a notebook or notepad. The rule works if you take into account spending even on small things, for example, to buy a pen or a magazine. This approach will allow you to see in which category you spend a lot and what you can refuse. Here are some obvious ways to save money that people ignore:

- use public transport more often than taxi;

- buy snacks in stores, not in cafes;

- give up an expensive gym membership and buy it during sales and seasonal/holiday offers, or switch to online workouts altogether;

- cook yourself, not order ready-made food with delivery.

Tip №7. Don’t neglect planning

Is your birthday coming soon? Allocate the amount in advance and do not exceed the budget. Is there a family celebration, a trip or a party? Cut your monthly budget a little to keep up, or take a part-time job.

Tip №8. Increase your income

To save less, you need to earn more. Think about how to increase your income. One option is to monetize your hobby or useful skills: photography, writing texts, creating illustrations or 3D graphics. This type of additional earnings gives you the opportunity to become self-employed and take orders from legal entities. Perhaps you will be able to put your own business on stream at all, which will significantly improve your financial situation.

Tip №9. Don’t save up unnecessary things

You have a fashionable coat, but you don’t wear it because it’s uncomfortable for you — it’s perfect for someone, so you can sell it. A massive oak cabinet takes up a lot of space — get rid of it and buy a stylish bookcase that won’t eat up space. In a word, conduct an audit. You’ll be surprised how much you can get for things you don’t need.

Tip №10. Deal with credit cards

Credit cards are a good thing, they help out to paycheck and help to buy an expensive thing right away without going to the bank’s office. But it is better not to allow delays. If there are several credit cards, first of all pay off the debt at the one with the highest rate. Think about it before you make an impulsive purchase: the first rule of a financially literate person is to spend less than earn. When used correctly, credit cards can also help in saving money — for this, choose cards with a free issue and cashback, which allow you to return interest for purchased goods and services.